XRP Price Prediction: Can Bulls Break $3.80 Amid Whale Accumulation and ETF Buzz?

#XRP

- Technical Strength: Price above 20-day MA + MACD bullish crossover

- Market Catalysts: Whale activity, ETF speculation, and legal clarity

- Risks: Unscheduled token unlocks may trigger profit-taking

XRP Price Prediction

XRP Technical Analysis: Bullish Signals Emerge

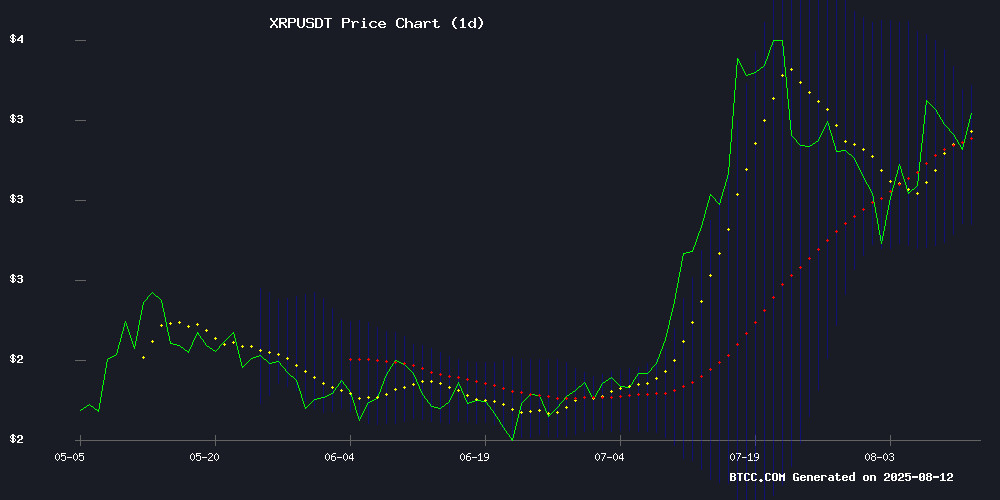

XRP is currently trading at 3.1393 USDT, above its 20-day moving average of 3.1027, indicating a bullish trend. The MACD shows a positive crossover with values at 0.1061 (MACD line), 0.0958 (signal line), and 0.0104 (histogram), reinforcing upward momentum. Bollinger Bands suggest potential volatility, with the price NEAR the middle band (3.1027), while the upper (3.3583) and lower (2.8471) bands provide key resistance and support levels.

XRP Market Sentiment: Whale Activity and ETF Hype Fuel Optimism

Recent headlines highlight strong bullish sentiment for XRP, driven by whale accumulation, exchange inflows, and ETF speculation. BTCC analyst Emma notes, 'The combination of technical strength and positive news FLOW could propel XRP toward the $3.80 resistance level.' However, unscheduled token unlocks ($3.2B) may create short-term selling pressure.

Factors Influencing XRP’s Price

XRP Bulls Target $3.80 Breakout Amid Whale Activity and Exchange Inflows

XRP's recent 20% rally has traders eyeing a potential breakout to $3.80, despite signs of waning momentum. Whale transactions totaling $108 million moved to Coinbase, while exchange reserves climbed—traditionally a precursor to profit-taking.

The altcoin's trading volume dipped 15% as prices approached all-time highs, suggesting cautious participation. Chart patterns remain bullish, but on-chain data reveals underlying tension between long-term holders cashing out and speculative demand.

Paxos Reapplies for U.S. National Trust Bank Charter Amid Crypto Regulatory Push

Paxos has renewed its bid for a federal trust bank charter, a move that WOULD place its digital asset operations under direct oversight by the U.S. Office of the Comptroller of the Currency. Approval would enable custody and payment services without deposit-taking authority—a hybrid model reflecting crypto's evolving regulatory landscape.

The firm currently operates under New York state supervision. A federal charter would signal stronger compliance credentials globally, though insiders confirm no immediate business model changes. This marks Paxos' second attempt after a 2021 conditional approval lapsed in 2023.

Anchorage Digital remains the sole crypto firm with an active OCC charter. The regulatory race intensifies as Circle and Ripple file parallel applications, suggesting institutional crypto players increasingly prioritize federal legitimacy over state-by-state approvals.

XRP Shows Renewed Strength as Price Prediction Models Signal Potential Breakout

Ripple's native token XRP has surged above the key psychological barrier of $3.00, with technical analysis suggesting an 80% upside potential to $5.00. This marks a new phase in XRP's price discovery journey, drawing renewed attention from investors.

Cloud mining platforms like SIX MINING are capitalizing on this momentum, promoting passive income opportunities tied to XRP's performance. The platform claims users can generate up to $5,000 daily through cloud-based mining contracts without hardware requirements.

Market observers note the timing coincides with growing institutional interest in altcoins, though some analysts caution about the speculative nature of cloud mining returns. The cryptocurrency's volatility remains a double-edged sword for traders and miners alike.

Unilabs (UNIL) vs Ripple (XRP) vs SUI Blockchain: The Race for 5x Returns in 2025

The cryptocurrency market is witnessing a fierce competition among three standout projects: Ripple's XRP, SUI Blockchain, and Unilabs Finance. Each is vying for investor attention with unique value propositions and recent developments that could propel them to significant gains.

XRP has surged 10% in the past week following the conclusion of its prolonged legal battle with the SEC, now trading at $3.16. Analysts like GalaxyBTC predict a potential rise to $10, citing historical patterns of higher lows that previously preceded major breakouts.

Meanwhile, sui Blockchain continues to attract institutional interest through strategic partnerships and technological innovation. Its ecosystem growth positions it as a strong contender for outsized returns in the current market cycle.

Unilabs Finance emerges as the dark horse, leveraging AI-powered DeFi solutions to disrupt traditional finance. Its record-breaking presale performance and cutting-edge toolkit suggest substantial growth potential as it gains mainstream adoption.

Ripple’s Unscheduled $3.2 Billion XRP Unlock Shocks Community

Ripple jolted the XRP community with an unexpected release of 1 billion tokens from its escrow wallets, totaling $3.28 billion in value. The transfers, including a single 500-million-XRP movement worth $1.64 billion, occurred outside the usual monthly schedule, sparking speculation.

Blockchain tracker Xaif flagged the anomaly, noting Ripple typically unlocks 1 billion XRP predictably at each month’s start. The August 9 release followed a 700-million-token lockup just days prior, amplifying market uncertainty. Such deviations from protocol often trigger volatility as investors scramble to interpret strategic shifts.

XRP’s Bullish Pattern Meets Profit-Hungry Sellers—Will the Price Hold?

XRP's recent price surge has attracted profit-taking sellers, with on-chain data revealing a sharp decline in holdings among short-term investors. The HODL Waves metric shows wallets holding XRP for 3-6 months dropped from 12.07% to 8.93% of supply between July 20 and August 10, while the 1-3 month cohort fell from 6.78% to 5.83%.

Exchange reserves are climbing, signaling potential selling pressure ahead. This behavior often precedes short-term sentiment shifts before broader market trends change. The 1-3 month cohort's accumulation peaked when XRP traded NEAR $2.77, suggesting these holders are now capitalizing on recent gains.

XRP Emerges as Top Cryptocurrency Pick Amid ETF Anticipation

XRP's price trajectory from November 2024 to February 2025 showcased its explosive potential, surging from $0.50 to $3.40 before settling near $3. Institutional interest, historically muted, may soon ignite with the anticipated launch of spot XRP ETFs.

The SEC is reviewing multiple applications, with Bloomberg analysts assigning an 85% approval probability by mid-October. Such funds would eliminate barriers for traditional investors, mirroring Bitcoin and Ethereum's ETF-driven institutional adoption.

Market Optimism persists despite recent pullbacks. The cryptocurrency's third-largest market cap position and pending regulatory milestones create a unique risk-reward scenario. Prediction markets echo this sentiment, pricing approval at 78% likelihood.

Ripple (XRP) Shows Bullish Momentum Amid Strong Support

XRP has established firm support at $3, with technical indicators suggesting a potential retest of the $3.6 resistance level. The cryptocurrency's current uptrend appears sustainable, backed by bullish momentum across key metrics.

MACD and RSI indicators are printing higher highs, reinforcing the positive price action. A decisive MOVE above $3.3 could pave the way for a challenge of the all-time high at $3.6, where sellers may re-enter the market.

The daily MACD shows particular promise, with moving averages on the verge of a bullish crossover. Such confirmation would provide clear runway for further gains until the psychologically important $3.6 level.

XRP Poised for Major Breakout as Legal Clarity Nears

XRP stands at a critical juncture, with technical analysis suggesting an impending surge toward $10. Market expert Mr. Xoom identifies the cryptocurrency as entering its fifth and final Elliott Wave cycle—a pattern often preceding dramatic price movements. While conservative estimates project a $4-$10 range by 2030, imminent developments could accelerate this timeline.

The Ripple-SEC legal battle approaches its climax, with Judge Analisa Torres' ruling expected by August 11. This decision carries existential implications not just for Ripple, but for broader regulatory treatment of digital assets in the United States. Traders are positioning aggressively, with some technical models forecasting a parabolic move to $7-$10 upon resolution.

Market dynamics reveal XRP's historical tendency for violent price swings following regulatory milestones. The current accumulation pattern mirrors previous setups that preceded triple-digit percentage rallies. Separately, an undisclosed AI project gains traction among investors seeking alternatives to capitalize on the brewing bull market.

How High Will XRP Price Go?

Based on current technicals and market sentiment, XRP could test $3.80 if bullish momentum holds. Key levels to watch:

| Indicator | Value | Implication |

|---|---|---|

| Price | 3.1393 USDT | Above 20-day MA (bullish) |

| MACD | 0.0104 histogram | Upward momentum |

| Bollinger Bands | 3.3583 (upper) | Next resistance |